City Atlanta Homeowners Insurance Policy Explained

City Atlanta Homeowners Insurance Coverage Explained

Your residence is among one of the most substantial financial investments you'll ever before make. That's why safeguarding it with an extensive house owner's insurance coverage is necessary. In this article, we will certainly describe whatever you require to understand about home owner's insurance coverage in City Atlanta. From recognizing what it is and also its value to the crucial parts of a plan, we have actually obtained you covered. We will certainly likewise explore the variables affecting the price of property owner's insurance policy in City Atlanta and also exactly how to pick the appropriate plan for your demands.

In addition, we will certainly talk about means to decrease your home owner's insurance coverage prices as well as offer support on suing. Whether leasing, possessing a condominium, or a residence, this blog post has something for everybody. So allow's dive in!

Recognizing House owner's Insurance coverage

House owner's insurance policy supplies insurance coverage for building and also individual valuables, supplying obligation defense in case of injuries on the residential or commercial property. It assists cover repair service prices and also extra living expenditures if the residence comes to be unliveable. Numerous aspects effect insurance coverage expenses. It's necessary to recognize the terms like insurance policy protection, residence insurance plan, insurance company, underwriting, flooding insurance coverage, covered loss, militaries insurance policy, job, army discount rates, house owners plan, loss of use insurance coverage, affordable rate of interest, clinical costs, and also much more. Keep educated as well as select the appropriate insurance plan from Progressive, Travelers Insurance Policy, USAA, GEICO, Allstate, Army Insurance Policy (AFI), or Lemonade.

Get a Quote",<br/>"url": "https://www.whiteoakis.com/homeowners-insurance/",<br/>"sameAs": [<br/>"https://white-oak-insurance-services.business.site/",<br/>"https://www.facebook.com/whiteoakinsurance",<br/>"https://www.facebook.com/whiteoakwarnerrobins/",<br/>"https://twitter.com/WhiteOakIs",<br/>"www.tumblr.com/whiteoakinsuranceservices",<br/>"https://www.youtube.com/channel/UCOdxllGLfdapOfAgjwYuWog",<br/>"www.pinterest.com/WhiteOakInsuranceServices",<br/>"https://www.reddit.com/user/WhiteOakInsuranceSrv",<br/>"https://www.linkedin.com/company/whiteoakis/",<br/>"https://www.dailymotion.com/partner/x2tdfxt",<br/>"https://whiteoakinsuranceservices15.weebly.com/",<br/>"https://www.yellowpages.com/woodstock-ga/mip/white-oak-insurance-services-544582303",<br/>"https://www.manta.com/c/m1r6yqp/white-oak-insurance-services",<br/>"https://www.merchantcircle.com/white-oak-insurance-services-woodstock-ga",<br/>"http://tupalo.com/en/woodstock-georgia/white-oak-insurance-services-creekstone-ridge",<br/>"https://www.2findlocal.com/b/14779508/white-oak-insurance-services-woodstock-ga",<br/>"https://agent.travelers.com/ga/woodstock/345-creekstone-ridge",<br/>"https://www.mapquest.com/us/georgia/white-oak-insurance-services-488278599",<br/>"https://www.waze.com/live-map/directions/us/ga/woodstock/white-oak-insurance-services?to=place.ChIJRQYKFjlr9YgRfCr9lXVmVjQ",<br/>"https://www.provenexpert.com/white-oak-insurance-services/",<br/>"https://agent.travelers.com/ga/warner-robins/2306-moody-rd",<br/>"https://www.progressiveagent.com/local-agent/georgia/warner-robins/white-oak-insurance-services/",<br/>"https://insurance-agent.safeco.com/find-an-insurance-agency/agency/0341007203416236",<br/>"https://www.georgiacompanyregistry.com/companies/white-oak-insurance-services-llc/",<br/>"https://www.google.com/search?kgmid=/g/11f5k1vl6d",<br/>"https://local.google.com/place?id=3771314393182972540&use=srp",<br/>"https://www.google.com/search?kgmid=/m/0313mp",<br/>"https://en.wikipedia.org/wiki/Home_insurance"<br/>],<br/>"logo": "https://www.whiteoakis.com/wp-content/uploads/2023/04/Horizontal-Logo-Transparent-e1684598511553.png",<br/>"image": "https://www.whiteoakis.com/wp-content/uploads/2023/07/Home-Insurance-Agency-Nav.jpg",<br/>"description": "Compare homeowner's insurance rates in Georgia and find the best coverage for your home. Get quotes online from top-rated companies from an independent agency.",<br/>"address":<br/>"@type": "PostalAddress",<br/>"streetAddress": "345 Creekstone Ridge",<br/>"addressLocality": "Woodstock",<br/>"addressRegion": "Georgia",<br/>"postalCode": "30188",<br/>"addressCountry": "United States"<br/>,<br/>"geo":<br/>"@type": "GeoCoordinates",<br/>"latitude": "34.08928819999999",<br/>"longitude": "-84.52739319999999"<br/>,<br/>"hasMap": "https://goo.gl/maps/Kg3nMSYpiTubLopZ6",<br/>"openingHoursSpecification": [<br/><br/>"@type": "OpeningHoursSpecification",<br/>"dayOfWeek": "Monday",<br/>"opens": "09:00",<br/>"closes": "17:30"<br/>,<br/><br/>"@type": "OpeningHoursSpecification",<br/>"dayOfWeek": "Tuesday",<br/>"opens": "09:00",<br/>"closes": "17:30"<br/>,<br/><br/>"@type": "OpeningHoursSpecification",<br/>"dayOfWeek": "Wednesday",<br/>"opens": "09:00",<br/>"closes": "17:30"<br/>,<br/><br/>"@type": "OpeningHoursSpecification",<br/>"dayOfWeek": "Thursday",<br/>"opens": "09:00",<br/>"closes": "17:30"<br/>,<br/><br/>"@type": "OpeningHoursSpecification",<br/>"dayOfWeek": "Friday",<br/>"opens": "09:00",<br/>"closes": "17:30"<br/><br/>],<br/>"areaServed": [<br/><br/>"@type": "Country",<br/>"name": "United States"<br/>,<br/><br/>"@type": "AdministrativeArea",<br/>"name": "Georgia"<br/>,<br/><br/>"@type": "City",<br/>"name": "Woodstock, Acworth, Allatoona, Allatoona Pass, Alpharetta, Canton, Cartersville, Cobb County, Dunwoody, East Cobb, Hickory Flat, Holly Springs, Jasper, Kellogg Creek, Kennesaw, Marietta, Milton, Powder Springs, Roswell, Roswell, Sandy Springs, Smyrna, Willow Creek, Metro Atlanta, Atlanta"<br/>,<br/><br/>"@type": "City",<br/>"name": "Warner Robins, Abindon Green, Antebellum, North Avondale, Bonaire, Byron, Centerville, East Macon, Fort Valley, Jeffersonville, Macon, Marshaville, Perry, Powersville, Russell Glen, Robins Forest West, Echo Glen"<br/>,<br/><br/>"@type": "AdministrativeArea",<br/>"name": "Central Georgia"<br/><br/>],<br/>"aggregateRating":<br/>"@type": "AggregateRating",<br/>"ratingValue": "5",<br/>"ratingCount": "27"<br/>,<br/>"contactPoint":<br/>"@type": "ContactPoint",<br/>"contactType": "customer service",<br/>"telephone": "6785690113"<br/>,<br/>"priceRange": "$$"<br/>

What is Property owner's Insurance policy?

Property owner's insurance coverage is an essential building insurance policy that safeguards your house and also individual properties. It provides security versus different dangers like burglary, fire, and also criminal damage. Furthermore, it supplies obligation insurance coverage in case somebody obtains wounded on your building. Comprehending the range offered by house owner's insurance plan is important for home owners.

Significance of Property owner's Insurance policy

Property owner's insurance coverage gives crucial monetary security in case of unforeseen occasions. It aids cover the price of fixing or restoring your residence and also safeguards your individual possessions from burglary or damages. The obligation protection supplied by house owner's insurance coverage can likewise safeguard you from lawful costs. House owner's insurance coverage offers you assurance, recognizing you are economically shielded. Ensure to select a credible insurance company as well as assess your plan on a regular basis to guarantee you have sufficient insurance coverage.

Essential Elements of Property owner's Insurance coverage

When selecting the appropriate plan, recognizing the essential parts of property owner's insurance coverage is essential. House insurance coverage shields the framework of your house, while personal effects insurance coverage changes or repair services your personal belongings. Responsibility defense covers lawful expenditures if a person is harmed on your home, as well as Added Living Costs (ALE) insurance coverage aids with momentary real estate prices. By comprehending these elements, you can make a notified choice as well as make sure ample insurance coverage for your residence and also ownerships.

House Insurance coverage

Residence protection, an important part of home owners insurance plan, shields your house's physical structure. This consists of wall surfaces, roofings, as well as structures. In case of damages, residence protection aids cover the expense of fixing or reconstructing your residence. The quantity of protection you require depends upon aspects such as the dimension as well as worth of your house. It's essential to assess your house protection on a regular basis to guarantee it shows the existing worth of your residence. Looking for assistance from your insurance company can aid figure out the ideal residence insurance coverage for your requirements.

Personal Effects Protection

Personal effects protection is crucial for property owners insurance plan. It assists change or fix your valuables, such as furnishings, electronic devices, as well as clothes, in case of burglary or damages. The quantity of protection you require depends upon the worth of your individual properties. Take supply of your possessions and also maintain documents of their significance to identify the proper variety. Take into consideration including recommendations for useful products like fashion jewelry or art work. This makes sure that your insurance policy protection appropriately secures your properties.

Responsibility Defense

Obligation security is a vital part of house owners insurance policy. It covers lawful costs in case of injuries on your residential property and also damages brought on by you or a relative to somebody else's building. Picking the correct amount of responsibility protection is important to effectively shield your properties. Think about an umbrella plan for added defense past what your home owner's insurance coverage supplies. Review with your insurance policy representative to identify the ideal responsibility protection for your circumstance.

Added Living Expenditures (ALE) Protection

Added Living Costs (ALE) insurance coverage can be a lifesaver when your residence is harmed. ALE protection aids with momentary real estate prices, such as resort expenses, rental charges, as well as food costs. It is commonly a portion of your home insurance coverage. To make an insurance claim for ALE, monitor your invoices and also documents of expenditures. Comprehending your ALE protection is important for intending as well as planning for unanticipated occasions.

Variables Affecting the Expense of Home owner's Insurance policy in City Atlanta

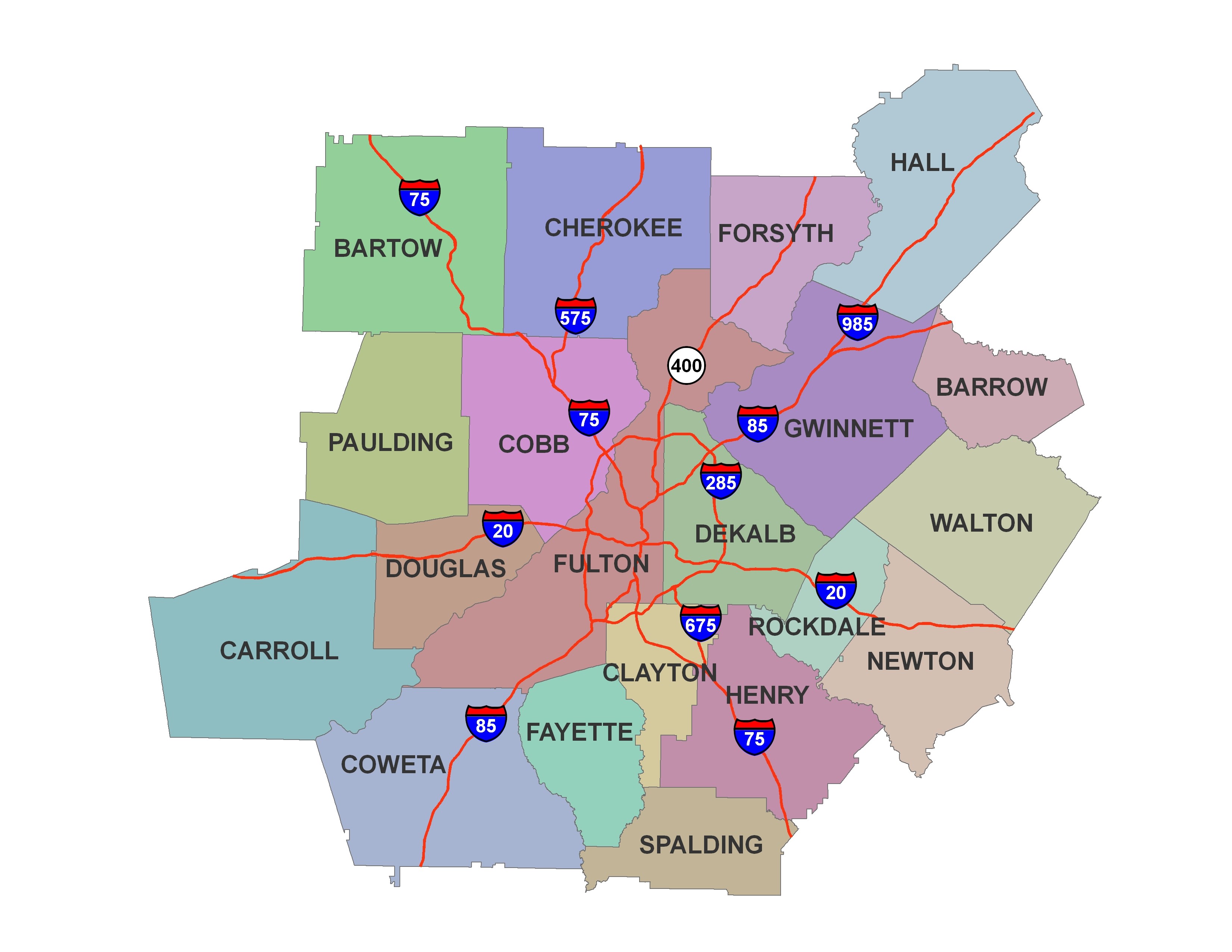

Aspects such as your house's place, area criminal activity prices, age as well as problem, building and construction products utilized, as well as distance to station house, as well as all-natural risks can all affect the price of house owners insurance policy in City Atlanta. Insurance companies take these variables right into account when establishing insurance policy costs. Recognizing exactly how these variables influence your insurance policy prices and also protection alternatives is vital. By taking into consideration these elements and also collaborating with a well-informed insurance provider, you can locate a house owners insurance plan that fulfills your requirements and also spending plan.

House Place as well as Community Criminal Offense Price

The place of a house plays a substantial function in establishing insurance coverage costs. Greater criminal offense prices in your area can lead to greater insurance policy prices, as insurance provider take into consideration the threat of burglary and also criminal damage when identifying costs. Improving protection, such as mounting a security system, might aid reduced insurance policy prices. It's necessary to understand the criminal activity price in your location and also its influence on house owner's insurance policy.

House's Age as well as Building and construction Kind

Age and also building and construction of a house play a substantial function in figuring out insurance policy prices. Older residences are usually related to greater costs as a result of possible dangers. Insurance provider take into consideration the building and construction products and also approaches made use of, as specific building and construction kinds might receive discount rates. Comprehending your house's age as well as building is crucial in establishing your protection requirements as well as guaranteeing you have the ideal insurance policy protection.

Credit Rating and also Insurance Claims Background of the Home owner

Insurance provider think about property owners' credit report and also insurance claim background when establishing house owner insurance coverage prices. An excellent credit history can cause reduced costs, while a bad credit history might bring about greater prices. In addition, keeping a claims-free background can cause price cuts on property owner insurance coverage. It is essential for property owners to assess their credit history and also cases background in order to locate budget-friendly protection that fulfills their demands.

Picking the Right Home owner's Insurance coverage

When picking a property owner's insurance coverage, analyzing your insurance policy requires based upon home worth and also individual valuables is necessary. Contrasting plans from various insurance provider will certainly permit you to discover the most effective protection choices, such as responsibility and also personal effects security. Search for added recommendations that can tailor your plan to satisfy your details requirements. Consulting with a neighborhood representative will certainly guarantee you have sufficient protection for your house.

Examining Your Insurance Coverage Requirements

Analyzing your insurance policy requires is a vital action in protecting the correct insurance coverage. Beginning by figuring out the worth of your residence and also its materials, thinking about prospective threats such as all-natural calamities or burglary. Take into consideration the individual responsibility insurance coverage called for as well as assess your capability to manage out-of-pocket costs. In addition, evaluate any type of certain insurance policy needs based upon your home mortgage or place. By extensively evaluating your requirements, you can make certain that your home owners insurance policy supplies the required defense.

Contrasting Quotes from Various Insurance Provider

When contrasting quotes from various insurance provider, it's vital to think about numerous aspects. Beginning by acquiring quotes from numerous insurance providers to contrast prices. In addition, take into consideration the credibility as well as monetary security of each firm. Testimonial each plan's protection restrictions as well as exemptions to guarantee it straightens with your demands. Search for readily available price cuts or motivations supplied by the insurance companies. Finally, look for suggestions from good friends, household, or on the internet sources to collect understandings on consumer experiences.

Just how to Lower Your Property owner's Insurance coverage Price in City Atlanta

Boost your residence's safety and security steps to minimize the threat as well as possible insurance policy protection. Disaster-proof your house versus threats to safeguard your residence and also items. Elevate your insurance deductible as well as think about packing your home owner's insurance policy with various other plans for possible price cuts. On a regular basis evaluation and also upgrade your plan to make sure ideal protection. Executing these actions can decrease your house owner's insurance policy expense in City Atlanta.

House Safety And Security Actions

To boost the safety of your residence, think about carrying out numerous actions. Setting up a monitored safety system can hinder robbers and also offer satisfaction. Usage deadbolt locks on all external doors to raise resistance versus burglaries. Mounting This Article Is More In-Depth as well as smoke alarm throughout your residence can aid shield versus possible fire threats. For included defense, take into consideration including protection cams. Finally, signing up with a neighborhood watch program can boost area security as well as give an added layer of safety and security.

Disaster-Proofing Your Residence

Disaster-proofing your residence is essential to secure it from extreme weather condition and also possible damages. Strengthen doors and windows to stand up to high winds, and also protected hefty furnishings and also home appliances to stop them from creating damage throughout tornados. Furthermore, cutting trees and also eliminating dead branches lowers the threat of dropping, while setting up tornado shutters guards home windows from solid winds. Think about including a back-up power generator for emergency situations triggered by power interruptions. By taking these safety nets, you can secure your house versus possible calamities.

Raising Your Insurance deductible

One method to possibly decrease your costs is by increasing your insurance deductible. Assessing your monetary capability to take care of a greater out-of-pocket expenditure is essential prior to making this choice. Reviewing the prospective cost savings with your insurance policy representative can aid you evaluate the benefits and drawbacks. In addition, take into consideration reserving reserve especially to cover the insurance deductible. Evaluating your plan completely will make certain that you comprehend the effect of a greater insurance deductible on your protection.

Submitting a Property owner's Insurance coverage Case

When confronted with a loss, it's important to call your insurance provider quickly. Ensure to record the damages or loss with comprehensive summaries as well as images. Supply all the inquired as well as sustaining paperwork to reinforce your case. Throughout the analysis procedure, comply completely with the insurance claims insurance adjuster. Do not fail to remember to maintain documents of all interaction and also costs associated with the insurance claim. You can browse the house owner's insurance policy case procedure efficiently as well as effectively by complying with these actions.

When to Sue?

Take into consideration submitting a property owner's insurance policy case when the expense of fixings surpasses your insurance deductible. Nonetheless, if the damages is small or less than your insurance deductible, paying of pocket might be much more economical. Prior to suing, consider the long-lasting influence on your insurance policy prices, as several cases can cause enhanced costs and even termination of protection.

Actions to Submit a Home owner's Insurance coverage Case

After experiencing a loss or damages, calling your insurer without delay is critical. Take comprehensive paperwork of the case with pictures, video clips, and also created summaries. Maintain documents of any type of costs associated with the damages or loss. Team up with your insurance policy insurer to evaluate the level of the damages and also identify insurance coverage. Follow up with your insurance provider to make sure reliable insurance claim handling and also repayment. Complying with these actions, you can browse the home owner's insurance coverage case procedure efficiently and also optimize your insurance coverage.

Property owner's Insurance policy for Occupants as well as Apartment Owners

Property owner's insurance coverage for tenants offers protection for individual possessions and also responsibility security. When leasing a home, safeguarding insurance policy protection is very important to secure your ownerships and also safeguard on your own from possible responsibilities. On the other hand, condominium proprietor's insurance coverage covers the person's device as well as encompasses typical locations within the structure. Added insurance coverage choices, such as flooding or quake insurance policy, can likewise be taken into consideration based upon particular requirements. Comprehending plan insurance coverage restrictions as well as deductibles is essential to make certain sufficient defense. Discount rates might be offered for security attributes like smoke alarm or safety and security systems.

Occupants Insurance policy

Tenant's insurance policy covers personal effects, obligation, and also extra living costs. It uses defense versus hazards such as fire, burglary, as well as particular kinds of water damages. Occupant's insurance policy additionally covers clinical repayments if somebody is hurt in your rental. Tenant's insurance coverage expenses are inexpensive and also can differ based upon insurance coverage restrictions and also deductibles. Evaluating your plan routinely guarantees it still fulfills your demands. Bear in mind to examine your plan for any type of updates or modifications.

Exactly how does house owner's insurance coverage vary for condominium proprietors?

Condominium proprietors have one-of-a-kind insurance policy requires contrasted to typical house owners. Apartment insurance coverage might cover usual locations and also shared residential or commercial property, while private insurance coverage is required for the indoor framework. Speak with your apartment organization as well as insurance policy representative to figure out the ideal variety for your device.

<br/>"@id": "#schema-2905",<br/>"@context": "http://www.schema.org",<br/>"@type": "NewsArticle",<br/>"headline": "How to Prepare for Hurricane Season: Top 6 Pre-Hurricane Preparation Steps",<br/>"image": [<br/>"https://www.whiteoakis.com/wp-content/uploads/2023/09/Home-Insurance-Prices-Going-up-Thumb-Name.jpg",<br/>"https://www.whiteoakis.com/wp-content/uploads/2023/09/Home-Insurance-Prices-Going-upBlog-Cover.jpg",<br/>"https://www.whiteoakis.com/wp-content/uploads/2023/09/Residental-Construction-Price-Increase.jpg",<br/>"https://lh3.googleusercontent.com/p/AF1QipMUX5JUTdQ-26YmDZzEs9dRFIaiKFNxw-kz_LSb=h305-no",<br/>"https://www.whiteoakis.com/personal-insurance/home-insurance/home-insurance-premiums-surge-across-georgia/#:~:text=Asasafeguard,uncharacteristicallythisyear."<br/>],<br/>"datePublished": "03 Sep, 2023",<br/>"dateModified": "03 Sep, 2023",<br/>"author":<br/>"@type": "Person",<br/>"name": "White Oak Insurance",<br/>"url": "https://www.whiteoakis.com/writer/white-oak-insurance/"<br/>,<br/>"publisher":<br/>"@type": "Organization",<br/>"name": "White Oak Insurance",<br/>"logo":<br/>"@type": "ImageObject",<br/>"url": "https://www.whiteoakis.com/#logo"<br/><br/>,<br/>"mainEntityOfPage":<br/>"@type": "WebPage",<br/>"@id": "https://www.whiteoakis.com/personal-insurance/home-insurance/home-insurance-premiums-surge-across-georgia/"<br/>,<br/>"about": [<br/><br/>"@type": "Thing",<br/>"name": "Home Insurance",<br/>"sameAs": [<br/>"https://en.wikipedia.org/wiki/Home_insurance"<br/>]<br/>,<br/><br/>"@type": "Thing",<br/>"name": "Property Insurance",<br/>"sameAs": [<br/>"https://en.wikipedia.org/wiki/Property_insurance"<br/>]<br/>,<br/><br/>"@type": "Thing",<br/>"name": "Inflation",<br/>"sameAs": [<br/>"https://en.wikipedia.org/wiki/Inflation"<br/>]<br/><br/>],<br/>"mentions": [<br/><br/>"@type": "Thing",<br/>"name": "Federal Reserve Bank",<br/>"sameAs": [<br/>"https://en.wikipedia.org/wiki/Federal_Reserve_Bank"<br/>]<br/>,<br/><br/>"@type": "Thing",<br/>"name": "Federal Reserve Bank Of St. Louis",<br/>"sameAs": [<br/>"https://en.wikipedia.org/wiki/Federal_Reserve_Bank_of_St._Louis"<br/>]<br/>,<br/><br/>"@type": "Thing",<br/>"name": "Office of Insurance and Safety Fire Commissioner",<br/>"sameAs": [<br/>"https://en.wikipedia.org/wiki/Insurance_commissioner"<br/>]<br/>,<br/><br/>"@type": "Thing",<br/>"name": "WTOC-TV",<br/>"sameAs": [<br/>"https://en.wikipedia.org/wiki/WTOC-TV"<br/>]<br/>,<br/><br/>"@type": "Thing",<br/>"name": "Associated Builders and Contractors",<br/>"sameAs": [<br/>"https://en.wikipedia.org/wiki/Associated_Builders_and_Contractors"<br/>]<br/><br/>]<br/>

Verdict

To conclude, having home owner's insurance coverage is important for securing your financial investment and also offering comfort. It covers numerous elements such as residence protection, personal effects protection, responsibility defense, as well as added living costs. The price of house owner's insurance policy in City Atlanta can be affected by area, age, building and construction kind, credit rating, as well as asserts background. To select the best plan, examine your insurance coverage requires as well as contrast quotes from various firms. Furthermore, you can reduce your house owner's insurance policy expense by applying residence safety and security procedures, disaster-proofing your residence, and also elevating your insurance deductible. In a loss, it's vital to comprehend when to sue and also adhere to the needed actions. Last but not least, tenants as well as apartment proprietors need to take into consideration obtaining the suitable insurance policy protection.